idaho inheritance tax rate

A few states have disclosed exemption limits for 2022. The District of Columbia moved in the.

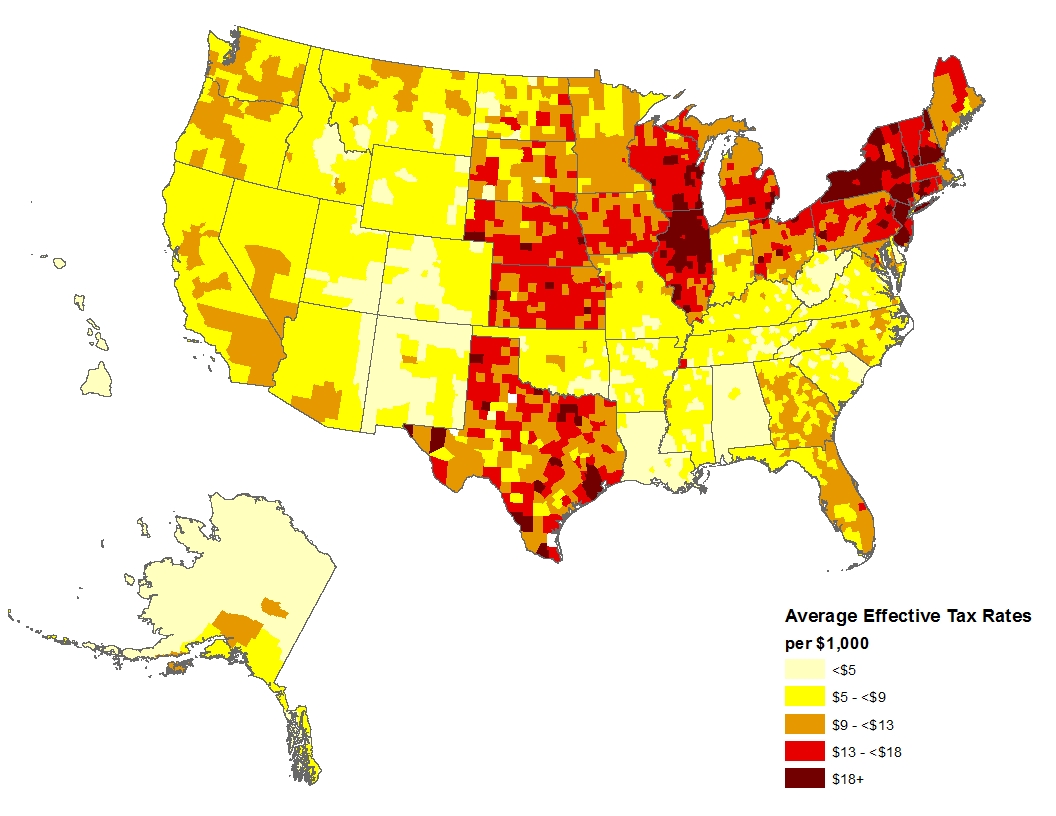

Property Taxes By State 2017 Eye On Housing

No estate tax or inheritance tax Illinois.

. Take a look at the table below. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. No Inheritance tax rates.

The inheritance tax is a tax on the beneficiarys gift. And if your estate is large enough it may be subject to the federal estate tax. Starting in 2023 it will be a 12 fixed rate.

Inheritances that fall below these exemption amounts arent subject to the tax. The Federal Unified Tax Credit was indexed at 5M per person plus inflation. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance.

You will also likely have to file some taxes on behalf of the deceased. In our current environment the probability is that an Idahoan will not have an estate that is subject to Estate Taxes. Page last updated May.

Idaho does not levy an inheritance tax or an estate tax. The tax rate ranges from 116 to 12 for 2022. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

In other words the estate itself can be taxed for the amount that is above the exemption cut-off. Has the highest exemption level at 568 million. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660.

The beneficiary of the property is responsible for paying the tax him or herselfâ. If the total value of the estate falls below the exemption line then there is no estate tax applied. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

Section 15-2-102 permits a surviving spouse to inherit the decedents entire estate if the decedent did not have children and her parents are deceased. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

108 - 12 Inheritance tax. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. There is no federal inheritance tax but there is a federal estate tax.

A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. Yes Estate tax exemption level. Select Popular Legal Forms Packages of Any Category.

And although the Federal Gift Tax applies to all US citizens it has an annual exclusion rate of 16000 per recipient. No estate tax or inheritance tax. In 2021 federal estate tax generally applies to assets over 117 million.

Idahos capital gains deduction. Inheritance taxes for Idaho residents. This is due to the fact that the assets youve inherited from the deceased person will need to exceed several millions of dollars in order for the estate tax to be levied typically set to around 5 million.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

Idaho has no state inheritance or estate tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. 71 million Estate tax rates.

Inheritance tax usually applies in two cases. As of 2015 each. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

The top estate tax rate is 16 percent exemption threshold. Technically there are 2 cases when an Idaho resident will become responsible for the tax due when they inherit. Maryland imposes the lowest top rate at 10 percent.

Eight states and the District of Columbia are next with a top rate of 16 percent. However like all other states it has its own inheritance laws including the ones that cover. The estate tax rate is based on the value of the decedents entire taxable estate.

For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income. However more-distant family members like cousins get no exemption and pay an initial rate of 15. For more details on Idaho estate tax requirements for deaths before Jan.

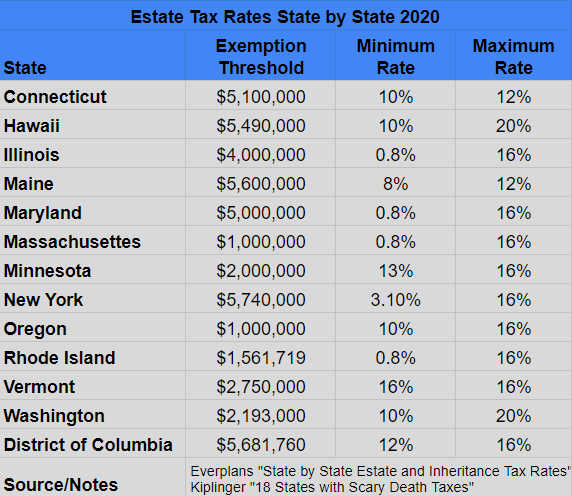

However the credit still receives support from both political parties. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Massachusetts has the lowest exemption level at 1 million and DC.

All Major Categories Covered. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. This number takes inflation into account as well so the current number is right around 545 million.

In other words you can gift away up to 16000 to as many people as. You must complete Form CG to compute your Idaho capital gains deduction. When the deceased person lived in.

The spouses share is one-half of the estate if there are children. The estate tax exemption for New York increases to 611 million while that for Washington state remains unchanged at nearly 220 million. Being indexed is kind of like saying the UTC is permanent until it is not.

Highest State Real Estate Tax Rates Real Estate Advocate

Current New Jersey Sales Tax Rate Off 74

How Is Tax Liability Calculated Common Tax Questions Answered

How Property Tax Rates Vary Across And Within Counties Eye On Housing

Kickstarter The Brilliant Site That Lets You Fund Strangers Brilliant Ideas Let It Be Kickstarter Stranger

Real Estate Taxes By State 2013 Eye On Housing

4 Things You Need To Know About Inheritance And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

States With Highest And Lowest Sales Tax Rates

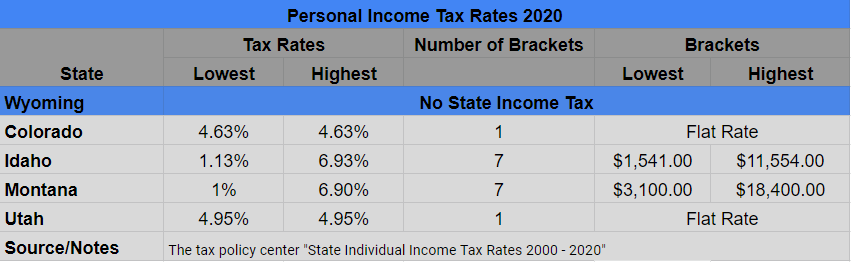

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Picking An Estate Planning Lawyer In Boise Is Sufficiently Simple When You Know Precisely What You Are Sea Estate Planning Estate Planning Attorney How To Plan

Housing Tax Estate Tax Tax Rate Tax

How Is Tax Liability Calculated Common Tax Questions Answered